A “feud” between two powerful businessmen causes a stir.

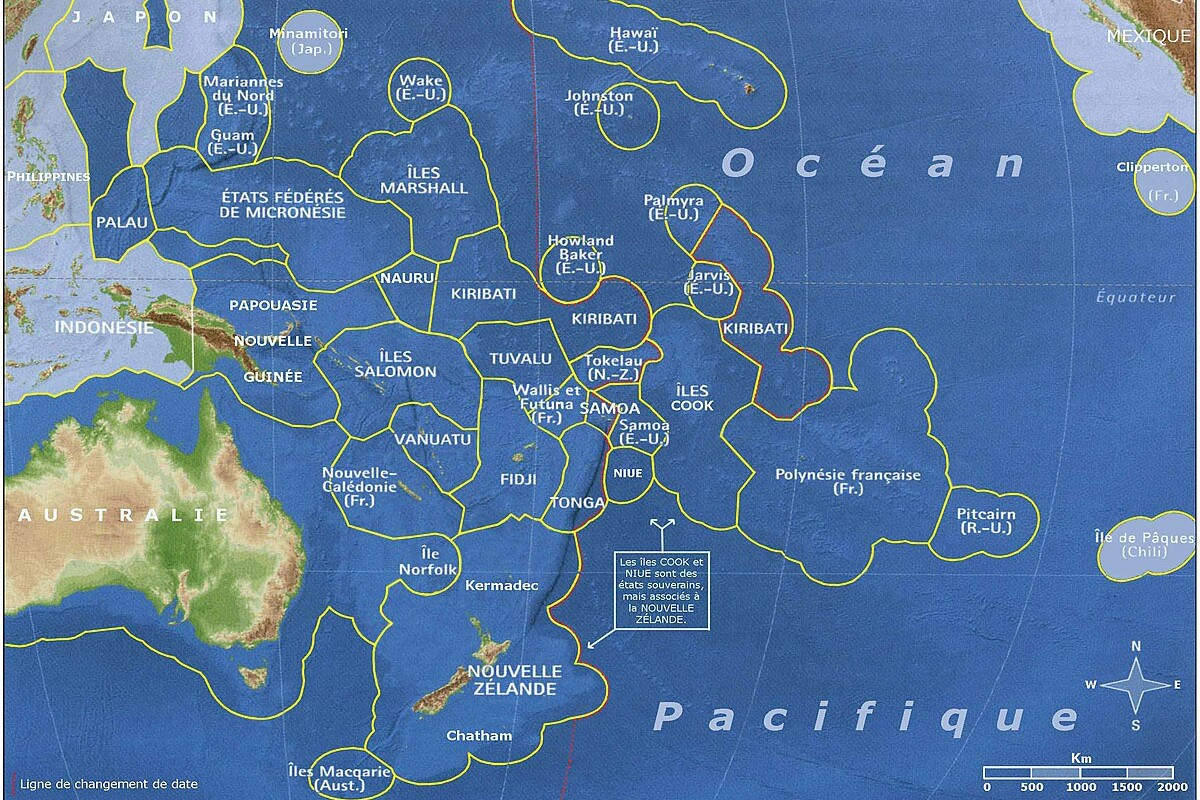

On my left, the Moux dynasty. Albert, the 79-year-old father, and his son Patrick, the ebullient boss of Vodafone Pacifique, both directors of the Pacific Island Energy (PIE) group. The core business of this family-run company is to source refined petroleum from Singapore, provide transport and distribute gasoline at the pump under the Shell brand to a dozen or so islands in the region.

On my right is Gaspard Ravel, 83, a self-made man through and through. After landing on the island of Tahiti at the age of 18, the man nicknamed “Bill” made his fortune by building up hundreds of businesses in shipping, freight and passenger transport, air transport and real estate, in New Caledonia, Tahiti and Australia.

A document leak

In recent days, relations between the two men have deteriorated sharply. Patrick Moux is furious with the man who was his business partner for many years. He is adamant that “Bill” is behind a leak of documents, some of which, considered confidential, are circulating between the Pacific and mainland France. The origin of this leak has yet to be verified.

What are they? From the documents we have been able to consult, it appears that PIE, the Moux holding company, is based in Singapore. This is where the company has been registered for many years. So far, nothing illegal.

Big profits

The results of this company, which employs just three people, are impressive on the Asian financial market: in 2022 alone, sales revenue reached one billion US dollars, gross margin was 230 million and profit was 100 million (again in US dollars).

PIE’s detractors, who wished to remain anonymous, believe that the company would not properly redistribute, through taxation, the substantial profits it derives from its business in the various territories it serves.

This is to the detriment of both consumers and local governments. In other words, PIE prefers to pay taxes in Singapore rather than pass them on to the territories it serves.

It’s worth pointing out that in most of the region’s islands, for both structural and cyclical reasons, consumer price levels are sometimes very high.

Tax optimization

When contacted, PIE’s managers defend themselves tooth and nail. They fully accept their decision to domicile their holding company in Singapore, for reasons of tax optimization. The main argument is that their company is dedicated to international business. Singapore is a very important and, above all, very attractive financial center. It’s true that companies benefit from an attractive tax regime: a 15% corporate tax rate instead of the 30 or 40% in territories such as New Caledonia or Tahiti.

In no way do PIE subsidiaries escape taxation in the islands they supply with petroleum products. At least, that’s what their managers told “FrenchDailyNews.com”.

Old cases come to light

For the time being, it is impossible to verify the amounts of these taxes, and therefore whether or not there is a shortfall in government revenue. Whether in Tahiti, Fiji or New Caledonia.

What is certain is that the response has been swift. PIE is considering suing Bill Ravel for defamation. And here come the old court cases and the various and sundry disputes. Among them, convictions that go back several years and that Bill Ravel has had inflicted on him.

To understand what’s at stake in this dispute, we need to “zoom out” and take the measure of the economic and geopolitical stakes in the Indo-Pacific region. Beyond questions of marine resources and gasoline supply for the multitude of territories in the Pacific, control of oil transport and storage is an essential priority.

Strategic bases

The Pacific is the scene of a muted struggle between the USA and China for control of sometimes tiny, but nonetheless strategic island bases. For its part, France is trying to preserve its presence in Polynesia and New Caledonia, which are highly coveted by the Chinese. Even if the loss of the huge submarine contract cancelled by Australia has weakened its position in the region.

Numerous negotiations are underway in an attempt to freeze the situation and strengthen French sovereignty in a highly coveted zone.

A French-led project

In association with the Malaysian oil company PETRONAS, a framework agreement, if approved, would enable a “club” of signatory territories – Fiji, Tahiti, New Caledonia and Papua New Guinea – to ensure not only the continuity of their regular supplies, but also the 90-day strategic storage period to which France is bound. For the time being, in reality, this represents only 30 days on average.